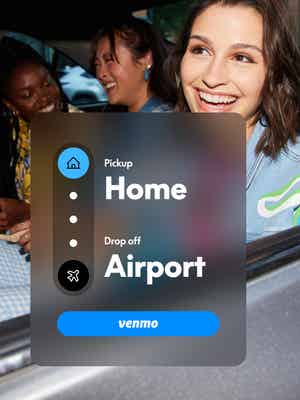

Venmo for business

Tap into younger, engaged shoppers

Help drive conversion when you give mobile-savvy shoppers a fast and familiar way to check out.

Grow your customer base

Get access to 95M active Venmo accounts by offering them a familiar payment option.1

Reach younger demographics

68% of Venmo users are Millennial or Gen Z.2

Boost conversion

Win more sales with a recognizable payment option that converts at 73%.3

Accept Venmo at checkout

Streamlined checkout

Offer a fast, intuitive checkout experience on your mobile app or website.

Flexible options

Customers can pay with the money in their Venmo balance plus any of their linked bank accounts, credit, or debit cards.

Trusted and secure

Let shoppers pay with confidence with Purchase Protection on eligible transactions.⁴

Add Venmo to your stack

Accept Venmo, PayPal, Pay Later, Apple Pay, Google Pay, and debit and credit cards. All with one checkout solution.

Real stories. Real results.

Pricing with no surprises

No monthly or setup fees. Only pay when you get paid.

3.49%

+$0.49 per transaction

Standard rate for domestic transactions. Fees are subject to change.

Custom pricing

For established businesses that process a large volume of payments annually.

No checkout? No problem.

Meet your new fave way to do business. Take payments, manage your business, and connect with clients. All you need is your phone and the Venmo app.

Showcase your unique brand

Turn your profile into your professional storefront.

Offer flexible, secure payments

Let customers pay via Venmo or with a card or digital wallet.

Keep more of what you earn

Enjoy low rates on each transaction. No monthly fee.

One platform.

Many ways to get paid.

Frequently asked questions

PayPal Open

One platform

for all business

Get paid. Get growing. Get ahead.

Do more with the platform designed to power commerce.